Cyber incidents cost Australian businesses nearly $33 billion each year, putting small and medium-sized companies at serious financial risk. As threats grow more sophisticated, many Brisbane SMBs find themselves underprepared for the aftermath of a cyber attack. Cybersecurity insurance has become a lifeline for businesses seeking protection against mounting digital dangers. This article demystifies how the right policy can shield your company from costly disruptions while supporting your ongoing recovery and reputation.

Table of Contents

- Defining Cybersecurity Insurance for SMBs

- Types of Cybersecurity Insurance Policies

- Core Coverage Areas and Exclusions

- Legal and Compliance Requirements in Australia

- Assessing Risks and Calculating Insurance Costs

- Selecting and Managing a Policy Effectively

Key Takeaways

| Point | Details |

|---|---|

| Importance of Cybersecurity Insurance | Cybersecurity insurance is becoming essential for SMBs to protect against financial losses from digital threats and incidents. |

| Types of Coverage | Policies typically cover both first-party losses (direct impacts on the business) and third-party liabilities (legal claims from affected parties). |

| Key Exclusions | Businesses must understand exclusions in policies, such as intentional employee acts and pre-existing vulnerabilities, to ensure adequate protection. |

| Ongoing Policy Management | Regularly reviewing and updating cybersecurity insurance policies is crucial for maintaining effective coverage in response to evolving threats. |

Defining Cybersecurity Insurance for SMBs

Cybersecurity insurance is a specialized risk management strategy designed to help small and medium-sized businesses (SMBs) mitigate potential financial losses from digital security incidents. According to Home Affairs, general insurers in Australia provide stand-alone cyber insurance policies covering a comprehensive range of potential digital threats.

Cyber insurance serves as a critical financial safety net for businesses, protecting against potentially devastating economic consequences of cyber incidents. Typical coverage includes protection for several key areas:

- Loss or damage to digital data and systems

- Content-related legal claims

- Expenses related to preventing future security breaches

- Regulatory fines and penalties

- Public relations management costs

- Cyber extortion reimbursement

- Third-party data protection liability

As outlined by Australian Government Finance, these policies can respond to both first-party and third-party losses. First-party losses might include direct impacts like business interruption, revenue loss, hardware damage, and data recovery expenses. Third-party losses typically involve legal liabilities arising from data breaches or system failures that impact external stakeholders.

For Brisbane SMBs, cybersecurity insurance isn’t just an optional extra – it’s becoming an essential component of comprehensive business risk management. With cyber threats evolving rapidly, having a robust insurance policy can mean the difference between quick recovery and potential business collapse. By understanding and investing in the right coverage, businesses can create a financial buffer that complements their existing cybersecurity infrastructure and provides peace of mind in an increasingly digital business landscape.

Types of Cybersecurity Insurance Policies

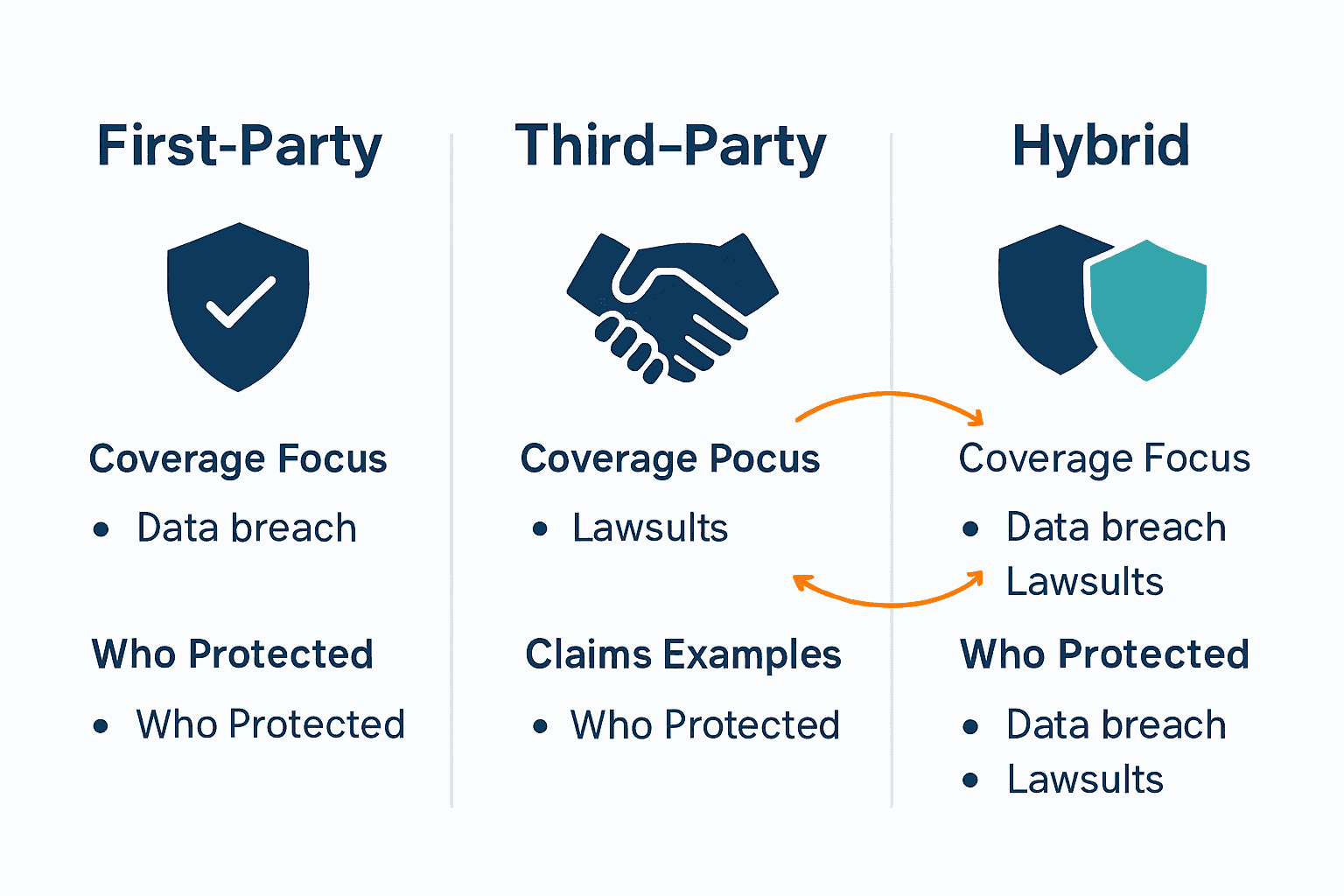

Cybersecurity insurance policies have evolved to provide comprehensive protection for small and medium-sized businesses facing increasingly complex digital risks. Australian Government Finance highlights that these policies typically address two primary categories of potential losses: first-party and third-party cyber incidents.

First-Party Cybersecurity Insurance Policies cover direct financial impacts experienced by the business itself. These policies protect against:

- Business interruption and revenue loss

- Physical damage to network infrastructure

- Hardware and equipment replacement

- Data recovery and restoration expenses

- Additional operational costs resulting from cyber incidents

Third-Party Cybersecurity Insurance Policies focus on external liabilities and legal consequences. These policies provide protection against:

- Legal claims from affected stakeholders

- Compensation for data breaches

- Regulatory fines and penalties

- Public relations and reputation management expenses

- Costs associated with notifying impacted parties

As outlined by Home Affairs, Australian insurers offer stand-alone cyber policies that can be customised to address specific business vulnerabilities. Businesses in Brisbane should carefully assess their unique digital risk profile when selecting coverage, considering factors like industry sector, data sensitivity, and existing cybersecurity infrastructure.

For SMBs seeking comprehensive protection, many insurers now offer hybrid policies that combine elements of first-party and third-party coverage. These integrated approaches provide a more holistic safety net, addressing both immediate financial losses and potential long-term legal and reputational risks. When exploring cybersecurity insurance options, work closely with providers who understand the nuanced digital threat landscape facing small businesses in today’s rapidly evolving technological environment.

Here’s a comparison of key differences between first-party, third-party, and hybrid cybersecurity insurance policies for SMBs:

| Coverage Feature | First-Party Policy | Third-Party Policy | Hybrid Policy |

|---|---|---|---|

| Main Focus | Direct business impact | Liabilities to external parties | Both internal and external risks |

| Common Claims | Data recovery Business interruption Hardware damage | Legal claims Fines Reputation costs | All first- and third-party events |

| Who is Protected | The insured business | Customers Partners Stakeholders | Business plus external stakeholders |

| Typical Policy Holders | Data-intensive SMBs | SMBs handling customer data | Businesses seeking full protection |

| Policy Customisation | Based on business operations | Based on liability risks | Integrated and flexible options |

Core Coverage Areas and Exclusions

Cybersecurity insurance policies are complex financial instruments designed to protect businesses from digital risks. According to Home Affairs, these policies typically cover a wide range of potential cyber incidents while also maintaining specific exclusions that businesses must understand.

Core Coverage Areas include comprehensive protection across multiple digital risk domains:

- Data loss and damage recovery

- Content-related legal claims

- Cyber breach prevention expenses

- Regulatory fine and penalty coverage

- Public relations management costs

- Cyber extortion reimbursement

- Third-party data protection liability

- Business interruption financial compensation

Key Exclusions represent critical limitations that businesses must carefully evaluate:

- Intentional criminal acts by company employees

- Pre-existing system vulnerabilities

- Infrastructure failures not directly caused by cyber incidents

- Losses from gradual system deterioration

- Reputation damage beyond specified public relations support

- Intellectual property theft not explicitly covered

As outlined by Australian Government Finance, first-party losses typically include physical network damage, business interruption, hardware replacement, and data restoration expenses. However, insurers often exclude property losses directly related to data corruption or systematic degradation.

For Brisbane SMBs, navigating these coverage nuances requires careful consultation with insurance professionals. Understanding the precise boundaries of your cybersecurity insurance policy is crucial. Businesses should conduct thorough risk assessments, review policy details meticulously, and potentially negotiate custom coverage that addresses their unique digital ecosystem. Remember, a comprehensive policy isn’t just about coverage—it’s about creating a strategic financial safety net that adapts to your specific operational landscape.

Legal and Compliance Requirements in Australia

Navigating the complex landscape of cybersecurity legal requirements is crucial for Australian small and medium-sized businesses. Australian Government Finance highlights the critical role of key government agencies in establishing comprehensive cybersecurity frameworks and guidelines for businesses.

Key Regulatory Frameworks that SMBs must understand include:

- Privacy Act 1988: Governs personal information protection

- Protective Security Policy Framework (PSPF): Provides guidance on information security

- Australian Government Information Security Manual (ISM): Outlines cybersecurity best practices

- Data Breach Notification Requirements: Mandatory reporting of significant security incidents

Primary Compliance Responsibilities for businesses involve:

- Implementing robust data protection mechanisms

- Conducting regular security risk assessments

- Maintaining comprehensive incident response plans

- Protecting personal and sensitive information

- Ensuring transparent communication about data breaches

According to Australian Government Finance, the Australian Cyber Security Centre (ACSC) plays a pivotal role in providing security advice and assistance to Australian entities. The Office of the Australian Information Commissioner (OAIC) further supports businesses by issuing critical guidelines for managing personal information security.

For Brisbane SMBs, compliance is not just about avoiding penalties—it’s about building trust and demonstrating professional integrity. Understanding IT Security Compliance becomes essential in this context. Businesses must proactively develop comprehensive cybersecurity strategies that not only meet legal requirements but also protect their operational integrity, customer data, and overall reputation in an increasingly digital business environment.

Assessing Risks and Calculating Insurance Costs

Understanding and quantifying cybersecurity risks represents a critical challenge for small and medium-sized businesses in Australia. Home Affairs highlights that many SMB operators struggle with comprehending their digital risk profile, which directly impacts their ability to secure appropriate insurance coverage.

Key Risk Assessment Factors businesses must evaluate include:

- Current technological infrastructure

- Volume and sensitivity of stored data

- Industry-specific cyber threat landscape

- Historical security incidents

- Employee cybersecurity awareness levels

- Existing technological vulnerabilities

- Potential financial impact of data breaches

Insurance Cost Calculation Components typically involve:

- Annual revenue

- Number of digital endpoints

- Data storage volume

- Industry risk classification

- Previous security breach history

- Complexity of IT infrastructure

- Geographic business location

- Current cybersecurity maturity level

According to Australian Government Finance, businesses may face substantial first-party losses including network damage, business interruption, hardware replacement, and data restoration expenses. These potential financial impacts underscore the importance of comprehensive risk assessment and tailored insurance solutions.

For Brisbane SMBs, professional risk assessment isn’t just a compliance exercise—it’s a strategic investment. Working with cybersecurity experts who can conduct thorough digital risk evaluations will help businesses understand their unique vulnerabilities, negotiate appropriate insurance coverage, and develop proactive risk mitigation strategies. Remember, the goal isn’t just insurance protection, but creating a robust, resilient digital ecosystem that minimises potential financial and reputational damage.

Selecting and Managing a Policy Effectively

Selecting the right cybersecurity insurance policy requires a strategic and nuanced approach for small and medium-sized businesses in Australia. Home Affairs emphasises that many SMB decision-makers struggle to understand the intrinsic value of cyber insurance, particularly when comprehending their digital risk landscape.

Essential Policy Selection Criteria businesses should consider:

- Comprehensive coverage scope

- Incident response support

- Pre and post-breach consultation services

- Flexibility in policy customisation

- Clear claims processing mechanisms

- Reputation management provisions

- Technology recovery support

- Financial loss compensation limits

Policy Management Best Practices include:

- Annual policy review and reassessment

- Regular risk profile updates

- Documenting all technological changes

- Maintaining detailed security incident records

- Training staff on policy requirements

- Establishing clear communication channels with insurers

- Conducting periodic vulnerability assessments

- Implementing recommended security improvements

According to Australian Government Finance, businesses may face significant legal liabilities and potential losses from cyber events. Therefore, proactive policy management isn’t just a recommended practice—it’s a critical business survival strategy.

For Brisbane SMBs, effective policy management means treating cybersecurity insurance as a dynamic, evolving protection mechanism. Understanding Cyber Security Methods becomes crucial in this context. Regular consultation with cybersecurity professionals, continuous risk assessment, and a commitment to ongoing security enhancement will help businesses maintain robust, relevant insurance coverage that genuinely protects their digital assets and operational integrity.

Protect Your Brisbane Business with Expert Cybersecurity Support

Cybersecurity insurance is essential for SMBs facing rising digital threats that can disrupt operations, drain finances or damage reputations. If you feel overwhelmed by complex risk assessments, confusing coverage options or compliance demands, you are not alone. Many Brisbane businesses struggle to navigate first-party and third-party coverage needs while managing evolving cyber risks. At IT Start, we understand these challenges and provide tailored cybersecurity services and managed IT support crafted specifically for your business size and industry. Our local Brisbane team helps you build a resilient digital environment that complements your insurance policies by strengthening security, reducing vulnerabilities and ensuring compliance.

Start protecting your business from costly cyber incidents today. Take advantage of our free consultation to assess your current cybersecurity posture and explore strategic IT solutions designed to lower risk and maximise your insurance benefits. Don’t wait until an incident impacts your bottom line. Contact us now at IT Start and let us help you create a cyber safe future for your business. Visit our contact page to book your free assessment or learn more about how our managed IT and cloud services support Brisbane SMBs just like yours.

Frequently Asked Questions

What is cybersecurity insurance?

Cybersecurity insurance is a specialized risk management tool that helps businesses mitigate financial losses arising from digital security incidents. It provides coverage for data loss, downtime, legal claims, and various expenses related to cyber incidents.

What types of coverage does cybersecurity insurance provide?

Cybersecurity insurance typically includes first-party coverage for business interruption, data recovery, and hardware replacement, as well as third-party coverage for legal liabilities, regulatory fines, and reputation management costs.

How do businesses assess their cybersecurity insurance needs?

Businesses should evaluate their digital risk profile by considering factors such as their technology infrastructure, the sensitivity of stored data, the nature of their industry, and historical cybersecurity incidents to determine appropriate insurance coverage.

What should businesses look for when selecting a cybersecurity insurance policy?

When selecting a policy, businesses should consider the coverage scope, incident response support, claims processing clarity, policy customisation options, and additional services like technology recovery and reputation management.

Recommended

- 7 Essential Cybersecurity Best Practices 2025 for Brisbane SMBs – IT Start

- Understanding Why SMB Cybersecurity is Essential – IT Start

- SMB1001 Explained: Certification and Business Value – IT Start

- Understanding IT Security Best Practices for SMEs – IT Start

- Cybersecurity for Small Business: Complete Guide – My Locksmiths

- Comprehensive hmo landlord insurance comparison – 2025